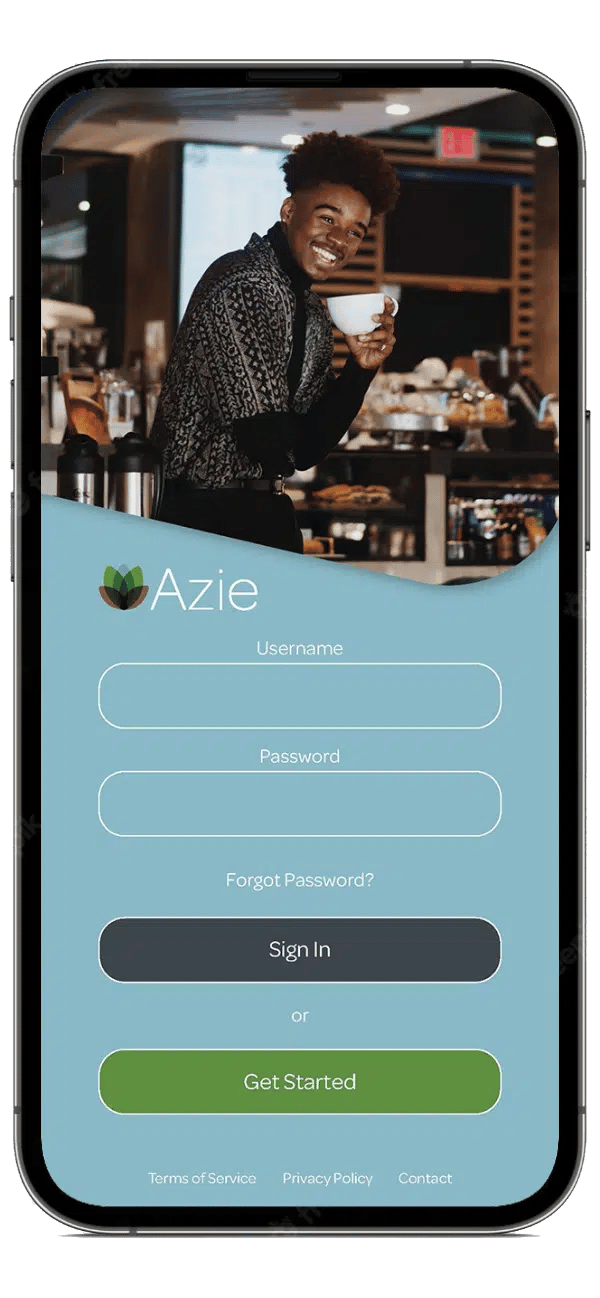

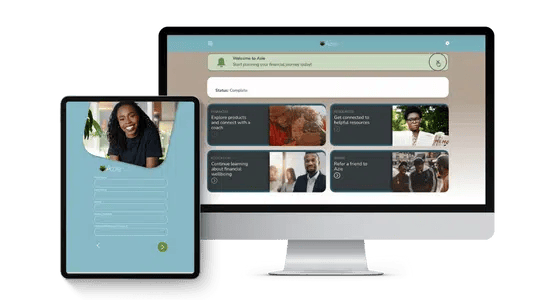

Azie App

About the Azie App

Azie connects Black and Brown Oregonians with financial products, services, and education from local credit unions that best align with their unique needs. Azie aims to foster financial and housing stability while creating and sustaining generational wealth for individuals and their families.

2023 Digital Growth Award

Unitus Community Credit Union received the 2023 Digital Growth Award from the World Council of Credit Unions (WOCCU) for their implementation of Azie. The award recognizes credit unions that implement digital solutions that promote financial inclusion, innovation, and scalability.

Overview

Project Financial Stability is a new and emerging financial outreach strategy. During 2020, the leadership at Unitus Credit Union (Unitus) identified a collaborative opportunity with the Urban League of Portland (ULP). The vision of the Unitus collaboration with the ULP is to assist ULP clients, no matter where they are in their journey, to overcome generational wealth disparities in the Black and African American communities.

To reach this vision of improved generational wealth in the Black community, Unitus has taken a leadership role in bringing together 5 area credit unions (CU), who are committed to the shared value of serving and lifting up underserved communities, specifically communities of color. These CU’s include Advantis, Rivermark, Point West, and Consolidated Community. They are all located in the Portland-metro area.

Collectively, these CUs will provide educational resources and affordable financial products and services to ULP clients. Products are all encompassing, including services that are specialized to meet the unique needs of ULP’s clients. They include, credit building loans, affordable small balance personal loans and first-time homeowner programs. These products are flexible and structured to meet the diverse needs of ULP clients.

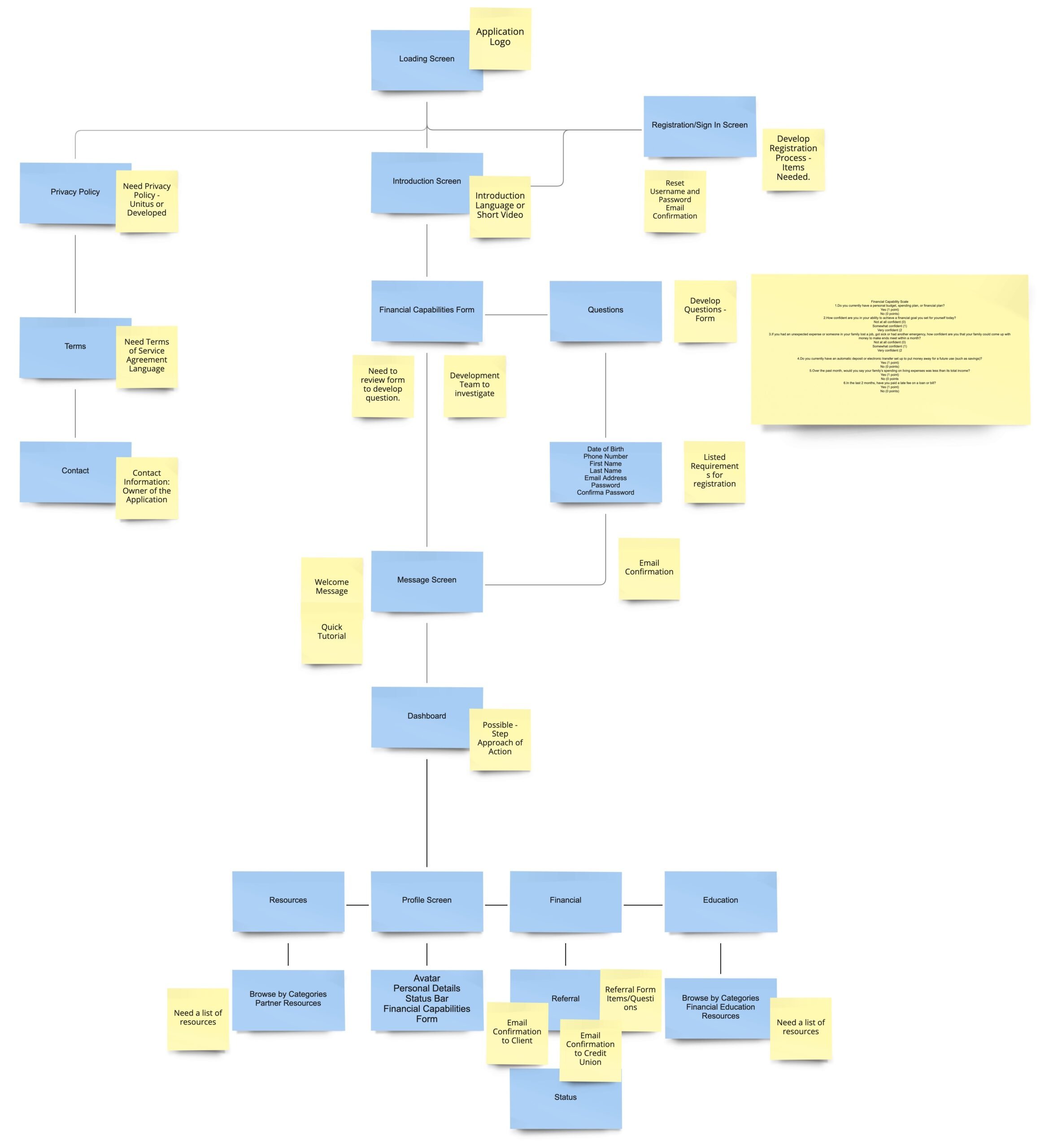

The purpose of this grant request is to develop a mobile application referral tool that will link ULP to each of the participating credit unions. The app will allow ULP clients to share their unique background information to help determine where they are at in their financial journey (in crisis, surviving, stable, or thriving) to offer recommendations that meet their educational and financial need. Through the app algorithm, an unbiased match for the partner credit union that has the most closely aligned education, product or service, and location to meet this particular need will be provided.

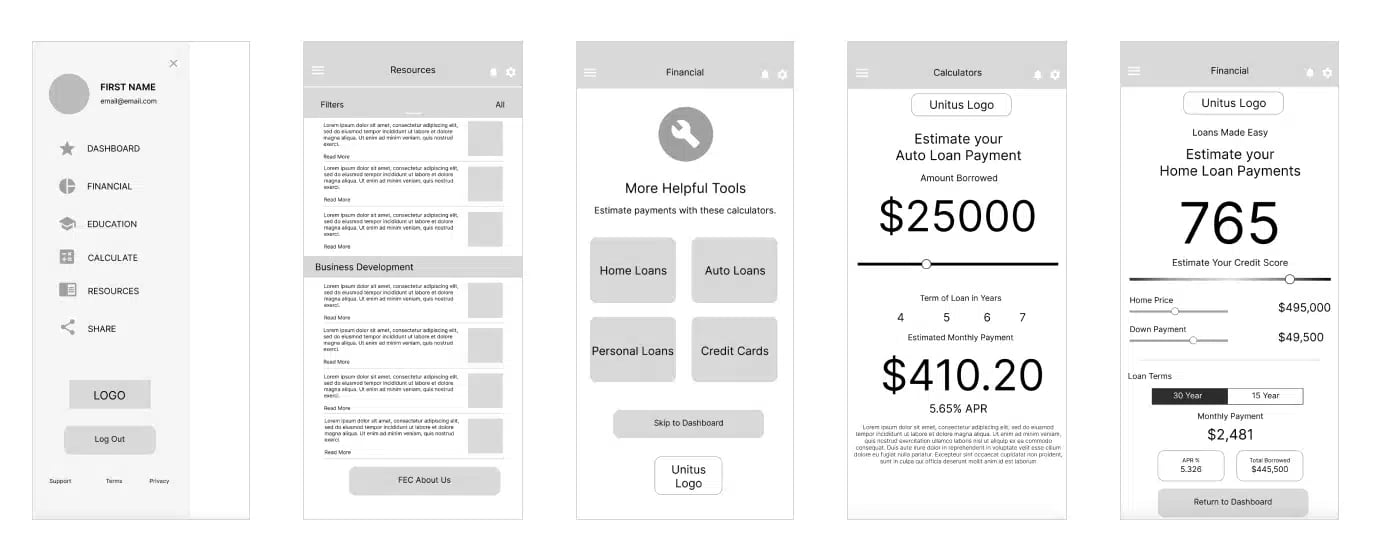

Process

Our FTSI App Development Team uses a mix of D4 and Agile methodologies to discover your concept, strategically design its consumer experience, develop it with best practices and deploy your app to the world. We provide you with the best opportunity to enter the app space with your best foot forward. Our Team of professional, cross-platform software developers have decades of experience. Our passion for software development and finding creative solutions to problems invigorates all aspects of our company.

Discover

How can you turn an idea into a successful app for your financial institution? It all starts here with strategic planning, landscape review, and goal setting. By reviewing the current landscape, we can establish a baseline of conversation. From your fears and hopes to traction items within each key channel, we will develop a clear picture of where your organization is. This strategic planning will iron out roadblocks and turn your hopes into a mechanism for achieving future success.

Design

With over twenty years of experience, the FTSI Design Team has a true sense of design. We leverage our strong background in graphic design, manual dexterity, and a keen eye for precision as the building blocks of our expertise. Not limited to traditional views of form and function, we constantly push to stretch boundaries and find exciting new creative direction. Our momentum to move forward has led us to expand into layout design, user interface, 3D modeling, and front-end mobile and web development.

Develop

The ability to visualize and execute development is essential in the infancy of a project. That’s why our development team is heavily involved during the brainstorming and workflow steps. Conceptualizing each success element is vital to our approach to ensure the correct first steps are taken in the creation of ground-breaking software. When a road map is not available, we help define one by touching and interacting directly with a wealth of new ideas and established techniques to follow.

Deploy

Once your app is live, it is a living thing that needs to change and grow with the industry.

We truly deliver the full package by continuing to support your app for as long as you need. We deliver the full package with distribution to Apple and Google stores, access to strategic marketing and consumer engagement tools, and continual support as your app grows with the industry.

Problem

Historically, low-income Black and African American populations are least likely to obtain approval for credit from mainstream financial institutions. Predatory institutions provide loans without a credit check but leverage these loans to make exorbitant amounts of profit when the borrower falls behind on a payment or becomes incapable of paying.

A significant challenge for these marginalized minority families is earning disparity. At the national level, the gap between Black and White annual household incomes is about $29,000 per year. In the Portland, OR area, African American family income is less than half that of White families, and the poverty rate among African American children is nearly 50% compared to 13% for white children.

Project Financial Stability aims to provide a solution using its products, services, and education to end the generational wealth gap in the Portland-metro black community.

These local equity and inclusion challenges matter to Unitus and the collaborators of Project Financial Stability. First, the purpose of the ULP and Unitus are congruent. Financial empowerment is a core purpose of Unitus. Second, local economic opportunities are limited because of financial injustice and exclusion. Project Financial Stability aims to remove financial barriers, thus increasing economic opportunity in the region. Increased economic opportunities improve education, health, employment, housing and financial security for the individual and the community as a whole. Financial access is key to removing racial inequalities. Unitus’ contribution to this project has other returns, such as improved community brand awareness and sustainable growth and consumer and community relevance.

Project Financial Stability provides a holistic approach to the generational wealth gap in the Black community.

Goal

Connecting Black Oregonians with financial products, services, and education from local credit unions that best align with their unique needs.

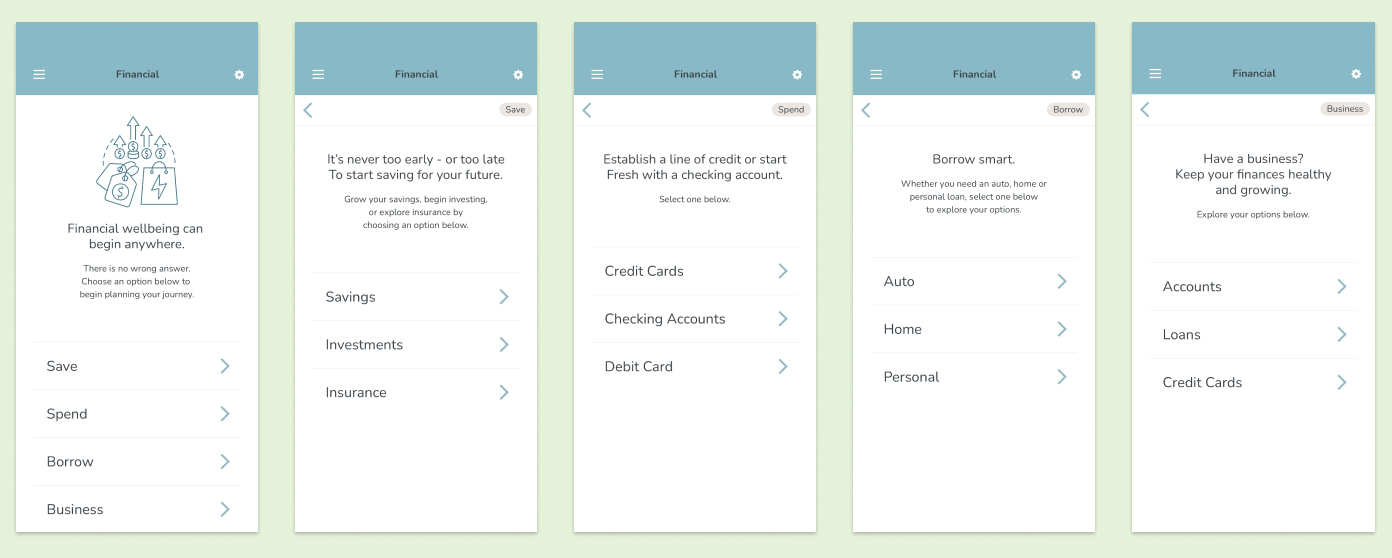

Key Features

Azie connects Black Oregonians with financial products, services, and education from local credit unions that best align with your unique needs. Azie aims to foster financial and housing stability while creating and sustaining generational wealth for underserved Black and Brown families.

Save

Grow your savings, begin investing and explore insurance.

Spend

Establish a line of credit or start fresh with a new debit card.

Borrow

Explore loan options for auto, home, or personal use.

Business

Keep your business healthy and growing with Azie.

Helpful Tools

Azie’s calculator tools help to estimate payments on home, auto, and personal loans as well as credit card balances.

Ability to browse financial education options and get users connected with resources to help them on the journey to financial wellbeing.

Azie connects users with a financial coach who is familiar with their needs to develop a personalized, achievable plan that works for them.

Inspiration behind the name

Named “Azie” after Azie Taylor Morton, the only African American woman to hold the position of Treasurer of the United States, the new mobile app aims to foster financial and housing stability while creating and sustaining generational wealth for underserved individuals and their families.

The incredible Azie Taylor Morton was a teacher, politician and the only African American to hold the position of Treasurer of the United States. Azie Taylor Morton’s story is a story of perseverance and empowerment. Morton, a sharecropper from rural Texas who became the Treasurer of the United States, is a testament to how one can defy unfair circumstances to become the champion of your own destiny.